The Treasury Department just released a proposed set of regulations that could have a meaningful impact on the retirement income market in the U.S.

The Treasury’s guidance package builds on feedback received in response to the request for comments issued by the Labor and Treasury Departments last fall.

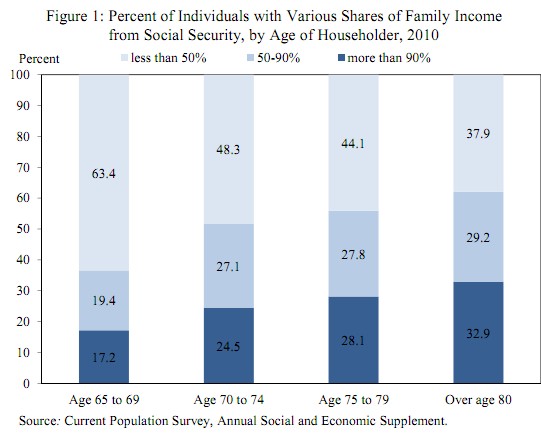

The proposed regulations appear to be squarely focused on longevity risk. The basis for this concern—particularly as it pertains to the middle class—is summarized in the following chart:

In a nutshell, people are running out of their own money as they age. This is evident in the increasing reliance on Social Security as people reach age 80.

The guidance package consists of the following:

1) Encourages “partial annuity options” from defined benefit pension plans:

This will make it easier for defined benefit plan sponsors to offer a combination of lump sum and annuity payouts. Currently, it is largely an all-or-nothing proposition for defined benefit plan sponsors and plan participants.

2) Removes “key obstacles to longevity annuities”:

The required minimum distribution that applies to the 401k and individual retirement account (IRA) markets impedes the use of longevity annuities or longevity insurance. Under the proposed fix, the required minimum distribution would be waived for a portion of “qualified” (401k and IRA) funds, so long as the amount does not exceed the lesser of 25 percent of the account balance or $100,000.

3) Clarifies how an employee can use 401k funds to purchase an annuity from an employer’s defined benefit pension plan:

This ruling makes it clear that an employer may offer a low cost annuity option through its defined benefit pension plan.

4) Simplifying spousal consent provisions for 401k plan sponsors who are interested in including a deferred annuity option in their plan:

Issues related to spousal consent have been obstacles to adoption of deferred annuity options (including longevity annuities) in 401k plans.

This ruling removes some of the burden and complexity surrounding spousal consent rules for 401k plan sponsors who are interested in offering a deferred annuity option.

Sources:

U.S. Department of the Treasury - Press Release, Fact Sheet

Executive Office of the President Council of Economic Advisers

- tom's blog

- Log in to post comments