The annuity industry is a large and increasingly important part of the financial services landscape. Millions of Baby Boomers are retiring and will be in need of stable sources of income and protection from longevity risk.

Given the industry’s size and importance, the lack of positive press, prevalence of negative press, and general misunderstanding of the products is truly staggering—just tune in to any Suze Orman show that involves a question on variable annuities.

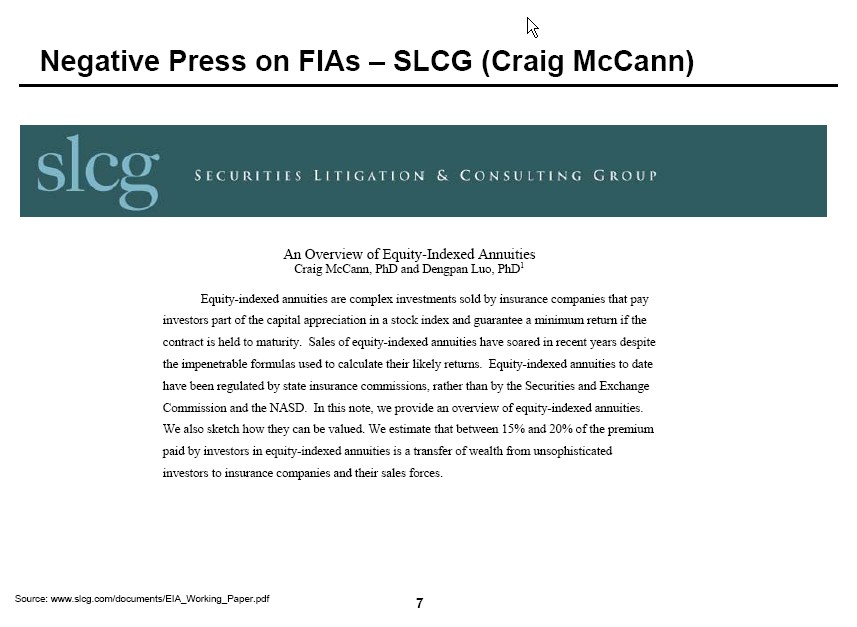

Negative press--particularly with fixed or equity indexed annuities--is easy to come by and most of it is the same. Common criticisms include costs, complexity, misleading sales tactics and illiquidity.

Objective analysis is a rarity—particularly among personal finance columnists.

This is why truly objective analysis such as the fixed indexed annuity from Wharton Professor David Babbel is so important.

Professor Babbel’s study has been profiled in several recent posts, each of which can be accessed through the following links:

One part of Professor Babbel’s study that has not been shared is his section on negative press on fixed indexed annuities. Professor Babbel places these slides at the beginning of the paper to place the rest of his findings in context.

Take a look at the slides below and then revisit Professor Babbel’s findings through the links above or simply looking at the homepage of Annuity Digest.

It is unfortunate that expert, informed and objective analysis such as Professor Babbel’s study is so hard to come by and often inaccessible for a non-professional audience. More unfortunate, though, is mindless press that keeps consumers in the dark about products that are so important and potentially beneficial.

- tom's blog

- Log in to post comments

Comments

CC replied on Permalink

Financial Media and Annuities

This is interesting.

I assume Professor Babbel is an authority in the industry. Why is the study so obscure and why not more press coverage around it?