Vanguard

Founded by the investment industry pioneer John Bogle, Vanguard is one of the world's largest investment management companies. Vanguard's mission is to help clients reach their financial goals by being the world's highest-value provider of investment products and services. Vanguard offers services to personal investors, institutional investors and financial advisors.

Overall, the company provides access to mutual funds, ETFs, securities and equities, financial management planning, retirement planning, college savings options, and premium services catered to high, net-valued customers.

Vanguard also offers annuity products. High level descriptions of select product categories include:

1) Mutual Funds: Diversified investments under the manage of Vanguard; categorized into Vanguard Funds and Core Funds.

2) ETFs, Securities, and Equities: Clients are allowed access to Vanguard's exchange-traded funds, thousands of stocks and bonds and cds, options, and investments on margin.

3) 401(k) Rollover: Offers services in transitioning from previous company to Vanguard's oversight. Vanguard specialists provide aid via phone.

4) IRAs: Vanguard offers both Traditional and Roth IRAs, both of which require a minimum of $3,000 in initial contributions in order to qualify under Vanguard's policies.

5) 529 College Savings Options: The company's College Savings Options include tax-deferred growth and tax-free qualified withdrawals, with many state plans providing state income tax benefits as well. Other benefits are: higher contribution limits, no income boundaries for account owners or age restrictions for beneficiaries, a range of investment options, and almost no restrictions on where the child goes to college.

6) Personal Services: Personal Services include Concierge Services for new accounts or 401(k) rollovers, Flagship Services for investors with $1 million or more in Vanguard mutual funds and ETFs and Voyager Services for investors with $50,000 to $500,000 in Vanguard mutual funds and ETFs.

| Vanguard Product Reviews |

|---|

Product Review of Vanguard Variable Annuity

I agree with almost everything said in the other reviews.

This Vanguard... Product Review of Vanguard Variable Annuity

The Vanguard variable annuity comes with an optional guaranteed lifetime... Product Review of Vanguard Variable Annuity

Very few people know what an annuity is.

Even fewer people know how annuities... Product Review of Vanguard Variable Annuity

Most annuities come with something referred to as a surrender charge.... |

| Products Offered |

|---|

| General Information | |

|---|---|

| Website | http://www.vanguard.com |

| Type | Asset Management |

| Founded | 1975 |

| Ownership | Private |

| Country | USA |

| Contact Information | |

|---|---|

| Address | PO Box 2600 Valley Forge, PA 19482 |

| Phone | 877-662-7447 |

| Fax | |

Information & Articles about Vanguard

|

It turns out that many target date funds are juiced by high yield or "junk" bonds. The issue is that target date funds (which presumably become more conservative over time as participants age) are riskier than what is generally perceived by consumers, regulators and financial advisors. This higher level of risk is consistent with the higher than expected volatility and losses experienced by many target date funds during the financial crisis. According to a recent Bloomberg article, up to 35 percent of target date funds hold some form of junk bonds in their fixed income holdings. Vanguard is one company that consciously avoids the use of high yield bonds in its target date funds. Source: Bloomberg

|

|

The Department of Labor has suspended a Bush Administration rule that would have allowed financial advisors to provide investment advice to their 401k customers. The Pension and Protection Act of 2006 contains a provision that allows financial advisors who manage company 401k plans to provide investment guidance to the 401k plan participants. The DOL suspended the rule out of concern for apparent regarding conflict of interest. The concern is that the advisors who sell products may have incentives to provide biased advice that is not in the best interests of the plan participants. The ruling will affect many firms, including companies such as Fidelity and Vanguard. The rule has been "withdrawn" which effectively means that the provision is dead. Sources: AP and Wall Street Journal |

|

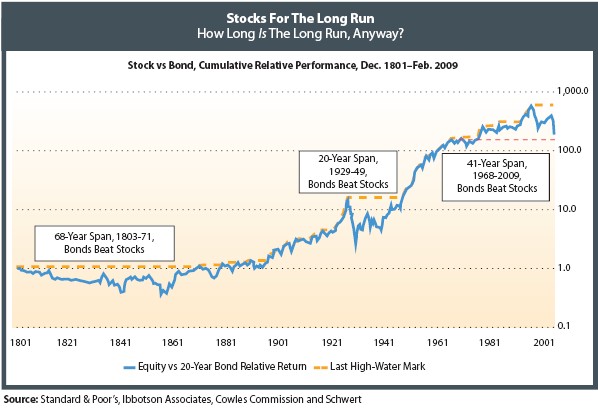

The U.S. Supreme Court is currently listening to arguments (which happen to have support from Vanguard founder John Bogle) regarding the ability to sue fund managers for passing along excessive fees to individual investors. A favorable ruling could put a dent in the $90 billion of fees generated by the industry annually. Meanwhile, Robert Arnott who is the Chairman of Research Affiliates recently published a paper that questions the need to bother with investing in anything other than Treasury bonds.

Arnott's research sheds light on the relative performance of equities and bonds over a very long time horizon. His findings include:

Arnott's findings stand in stark contrast to much higher equity risk premium assumptions that provide the raison d'être for most of the equity mutual fund industry. |

While efforts are made to keep information on this page accurate and updated, the information shown on this page may be variable or out of date. Always check the issuing company's website or other public data listings for the latest information applicable to you as actual information may vary.