The U.S. Supreme Court is currently listening to arguments (which happen to have support from Vanguard founder John Bogle) regarding the ability to sue fund managers for passing along excessive fees to individual investors.

A favorable ruling could put a dent in the $90 billion of fees generated by the industry annually.

Meanwhile, Robert Arnott who is the Chairman of Research Affiliates recently published a paper that questions the need to bother with investing in anything other than Treasury bonds.

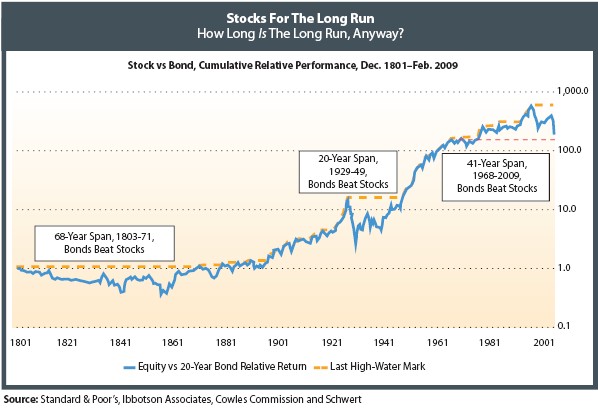

Arnott's research sheds light on the relative performance of equities and bonds over a very long time horizon. His findings include:

- The equity "risk premium" or expected return of stocks over bonds since 1802 is only 2.5%.

- Bonds have outperformed stocks for stretches well in excess of twenty years (including a 68 year stretch in the 19th century) on three separate occassions over the past couple hundred years.

- There has been a small negative risk premium (translation: bonds outperformed stocks) over the past forty years.

Arnott's findings stand in stark contrast to much higher equity risk premium assumptions that provide the raison d'être for most of the equity mutual fund industry.

- tom's blog

- Log in to post comments

Comments

Anonymous replied on Permalink

more people, even younger

more people, even younger people, should look at preserving capital first and foremost. instead of being fearful that they are going to miss out on some big return, they should give as much or more of their efforts focused on preserving their money. especially when other things, like jobs, are less stable.

tom replied on Permalink

Human Capital

Good comment.

The point you're making involves the relationship between human capital and financial capital.

Ideally the two should not be hugely correlated.

Human capital involves one's work or labor earnings. If someone works at an Internet start-up they may want to avoid have their financial assets largely invested in equities as their labor income or human capital already provides equity-like exposure (i.e. higher levels of volatility).

jeane replied on Permalink

Bonds After 40 Years...

Eye opening point on the last 40 years of stock and bond returns.

Doesn't it make sense, though, that there is a case to be made against bonds in favor of equities after a 40 year bull market for fixed income?

tom replied on Permalink

More on bonds versus equities

Just came across an article that discusses equity versus bond performance.

The authors make the case that it is highly unlikely that equities will outperform bonds moving forward:

http://corporate.morningstar.com/ib/documents/MediaMentions/AreBondsGoin...

tom replied on Permalink

Bonds versus equities

One sure would think that the tables are set to turn after 4 decades of steadily declining interest rates.

That said, you could have made the same case in Japan in the early 1990s.

Certainly a case to be made that we are in a similar deflationary environment with consumer balance sheet deleveraging.

Reminds me of something Warren Buffett said about the feasibility of predicting interest rates...