Warren Buffett does not need to think about an annuity. While Buffett’s age may qualify him for annuity consideration, his wealth is sufficient to fund any personal income needs that may arise. Also, concerns such as longevity risk and sequence of returns risk are non-issues for him.

At the other end of the spectrum are many people whose primary source of income during retirement is Social Security. Social Security payments are essentially a form of annuity income, so if a person’s retirement income and net worth is dominated by Social Security, there is really no need to further annuitize any assets.

So who actually needs to think about buying an annuity?

The reality is that it is probably easier to arrive at this answer by first thinking about the number of Americans who fall into the category of not needing an annuity.

Let’s start by taking a look at why it might not make sense for those with fewer assets on a comparative basis to consider an annuity:

- The number of Americans age 55 and older in 2009 is roughly 70 million.

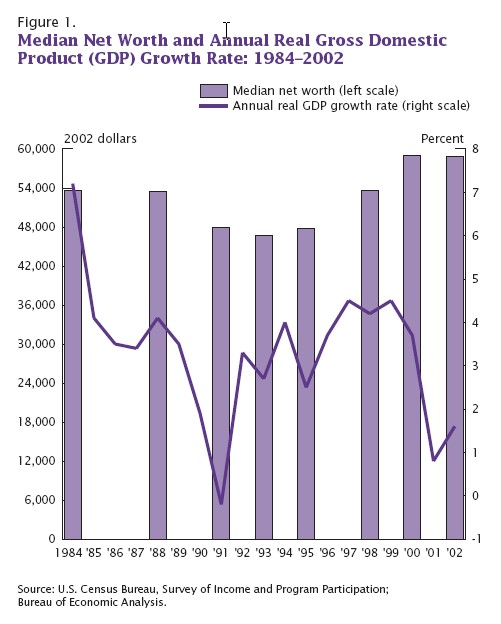

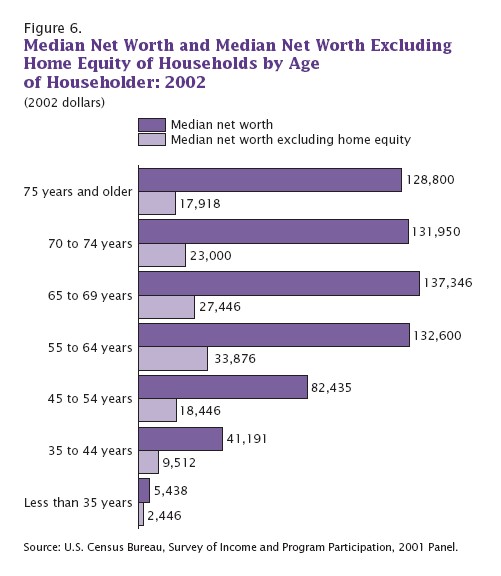

- According to the U.S. Census Bureau, the median net worth of U.S. households age 55-64 is $132,600.

- Excluding the value of home equity, the median net worth of U.S. households age 55-64 is $33,876.

- Social Security pays benefits to 90% of those aged 65 or older. It is the major source of income (providing 50% or more of total income) for 66% of the beneficiaries. It contributes 90% or more of income for one-third of the beneficiaries and is the only source of income for 22% of them.

- The average monthly Social Security payment is $1,061.50.

- The average life expectancy for a 65 year old in the United States is 18.7 years.

- Present value of that Social Security payment based on average life expectancy at 65 is $174,837.41

- This present value figure represents 83.7% of the median net worth excluding home equity—in other words liquid, investable assets.

- As a result, we can (roughly) assume there is really no need to further annuitize assets for at least 35 million people (50% of the 55+ population in the U.S.) since almost 84% of this population segment’s net worth is already in the form of an annuity.

- Further, we could probably assume no further need to annuitize for roughly 46.2 million out of 70 million people if Social Security provides 50% or more of total income to 66% of beneficiaries.

In the next post I’ll take a look at high net worth individuals and why they likely have very little need for annuities.

The third and last post will discuss those in the middle of the spectrum who do need to think about using annuities.

- tom's blog

- Log in to post comments

Comments

Bill Y replied on Permalink

How Much to Annuitize?

Is there a rough rule of thumb about how much to annuitize based on net worth, investable assets, etc?

Anonymous replied on Permalink

As for an amount to

As for an amount to annuitize, it differs from person to person. Liquidity is a key factor to consider. Annuitizing a portion of your assets will give you a specific income benefit that can be used for fixed costs for retirement. Be careful to leave a "comfortable" amount of your assets outside of the annuity in order to cover discretionary and unexpected costs that might arise.

tom replied on Permalink

How Much to Annuitize

Really good question.

I started a forum topic for this conversation which can be found here: http://www.annuitydigest.com/forum/how-much-annuitize